Best 5 Mint Alternatives

Written by: Hrishikesh Pardeshi, Founder at Flexiple, buildd & Remote Tools.

Last updated: Nov 15, 2024

Best Mint Alternatives are:

Personal Capital

YNAB

Quicken

PocketGuard

EveryDollar

If you’re searching for personal finance management tools other than Mint, there are plenty of great alternatives to explore. These options come packed with a variety of features to suit different financial needs and lifestyles. Maybe you want more in-depth investment tracking, better budgeting tools, or even a different pricing structure. Platforms like Personal Capital stand out for their powerful investment management, while EveryDollar keeps things simple with an easy-to-use budgeting interface. No matter what your financial goals are, these alternatives offer unique ways to stay on top of your finances and work toward your money goals.

Table of Contents

Why You Need Alternatives to Mint?

While Mint is a widely recognized budgeting app for managing personal finances, it may not meet the specific needs of every user. Mint users might seek alternatives for a variety of reasons, such as the need for more detailed investment tracking, a preference for different budgeting methodologies like the zero based budgeting method, or concerns regarding data privacy and security. Mint's free model is certainly attractive to many, but some users may find its features limited or desire more advanced functionalities that other budgeting apps, like Rocket Money or Monarch Money, offer.

For instance, if you're focused on improving your credit score or building your net worth, platforms like Credit Karma can provide tools tailored to those specific goals. Additionally, the user experience and interface design may not resonate with everyone, leading some to explore other options to better align with their personal preferences. Tools that help you track spending, create budgets, and manage your money effectively can make a significant difference in achieving your financial goals. Exploring alternatives can help you find a tool that better fits your financial goals, offers enhanced customization, or provides a more user-friendly experience tailored to your specific needs.

Who Should Consider Using Mint Alternatives?

You should consider using Mint alternatives if you're looking for more specific features, improved user interfaces, or different pricing models. These alternatives can cater to a variety of user needs, whether you're a seasoned investor, someone who is new to budgeting, or someone who requires advanced financial reporting tools. Here’s a detailed look at who might benefit from these alternatives and why:

Users Seeking Comprehensive Investment Tracking

If you're an investor who wants to closely monitor and manage your investment portfolio, Personal Capital offers robust tools that go beyond basic budgeting. It provides detailed insights into your investments, asset allocation, and retirement planning, making it ideal for individuals who want a holistic view of their financial health.

Personal Capital integrates various aspects of financial management, allowing users to track their investment performance, analyze their portfolio diversification, and receive personalized advice based on their financial goals. This comprehensive approach is particularly beneficial for those who have multiple investment accounts and need a centralized platform to manage them effectively.

Budget-Conscious Individuals

For those who prioritize strict budgeting and want to adopt specific budgeting methodologies, YNAB (You Need A Budget) is a powerful alternative. YNAB emphasizes proactive budgeting techniques that help users allocate every dollar effectively, encouraging disciplined financial habits and long-term financial stability. YNAB's philosophy revolves around giving every dollar a job, ensuring that your money is being used intentionally and that you're in control of your finances rather than your finances controlling you. This approach is beneficial for individuals who want to take a more hands-on approach to managing their money, setting clear financial goals, and sticking to their budgets to achieve financial independence.

Professionals Requiring Advanced Reporting

If you require detailed financial reports and analytics for better financial decision-making, Quicken offers extensive reporting features. It allows users to generate customized reports, track expenses meticulously, and manage multiple financial accounts, making it suitable for professionals who need in-depth financial analysis.

Quicken's advanced reporting capabilities enable users to gain deeper insights into their spending patterns, investment performance, and overall financial health. This level of detail is invaluable for individuals who need to monitor their finances closely, prepare for taxes, or manage complex financial portfolios that include investments, properties, and various income streams.

Users Preferring Different Pricing Models

For individuals who prefer different pricing structures, such as subscription-based services or one-time purchases, alternatives like PocketGuard and EveryDollar provide flexible options. Whether you prefer a free version with essential features or a premium subscription for advanced functionalities, these platforms cater to various budget preferences.

PocketGuard offers a straightforward, user-friendly interface with a focus on simplicity, making it ideal for those who want to manage their finances without the complexity of more feature-rich tools. EveryDollar, on the other hand, provides a clear and structured approach to budgeting, making it easy for users to follow and maintain their financial plans without the need for extensive financial knowledge.

Users Focusing on Debt Management

If managing and reducing debt is a primary financial goal, EveryDollar offers specialized tools that focus on debt tracking and repayment strategies. Its user-friendly interface helps individuals create and follow debt reduction plans, making it an excellent choice for those aiming to eliminate debt systematically. EveryDollar's approach to debt management includes features that allow users to set up payment plans, track their progress, and stay motivated to achieve their financial goals. By providing a clear roadmap for debt repayment, EveryDollar helps users stay focused and organized, ensuring that they can successfully reduce their debt over time and improve their overall financial well-being.

Mint Alternatives Comparison Table

| Feature | Personal Capital | YNAB | Quicken | PocketGuard | EveryDollar |

|---|---|---|---|---|---|

| Ease of Use | Moderate | Easy | Moderate | Easy | Very Easy |

| Pricing | Free & Paid Plans | Subscription-Based | Paid | Free & Paid Plans | Free & Paid Plans |

| Platform Support | Web, iOS, Android | Web, iOS, Android | Windows, macOS | iOS, Android | Web, iOS, Android |

| Investment Tracking | Extensive | None | Moderate | Basic | None |

| Debt Management | Basic | Advanced | Advanced | Moderate | Advanced |

Best Mint Alternatives

If you're searching for robust personal finance tools, exploring the best Mint alternatives can help you find the right fit. While Mint is a widely used choice for budgeting and expense tracking, other platforms offer unique features, customization options, and pricing models. Whether you’re a seasoned investor, a budgeting novice, or someone seeking advanced financial reporting, these alternatives provide fresh perspectives and tailored tools to enhance your financial management. Here’s a detailed look at some of the top Mint alternatives to consider for your personal finance needs.

Personal Capital

Personal Capital is a comprehensive personal finance tool that combines budgeting with advanced investment tracking. It's ideal for users who want to manage their day-to-day finances while keeping a close eye on their investment portfolios. Personal Capital's platform integrates various aspects of financial management, providing users with a clear picture of their overall financial health. The tool offers a range of features that cater to both budgeting and investment needs, making it a versatile choice for individuals who seek a holistic approach to managing their finances.

Personal Capital vs Mint

Personal Capital offers a more robust set of features focused on investment tracking and retirement planning compared to Mint, which primarily emphasizes budgeting and expense tracking. While both platforms provide budgeting tools, Personal Capital stands out with its detailed investment analysis, making it a superior choice for users looking to manage and grow their wealth.

Personal Capital also offers tools for retirement planning and wealth management, which are not as advanced in Mint, providing users with a more comprehensive approach to financial planning. Additionally, Personal Capital's user interface is designed to cater to individuals who are more investment-savvy, offering insights and data that are beneficial for those looking to optimize their investment strategies.

Key Features of Personal Capital

Comprehensive Investment Tracking: Personal Capital provides detailed analysis of your investment portfolio, including asset allocation, performance, and fees. This feature allows users to monitor their investments closely and make informed decisions based on real-time data.

Retirement Planning Tools: The platform offers tools to project your retirement savings and help you plan accordingly. These tools can help you set retirement goals, estimate future savings, and determine how much you need to save to achieve your desired retirement lifestyle.

Net Worth Tracking: Personal Capital allows you to monitor your overall financial health by tracking your assets and liabilities. This feature gives you a clear picture of your net worth, helping you understand your financial position at any given time.

Cash Flow Analysis: Understand your income and expenses with detailed cash flow reports. This feature helps you identify spending patterns, manage your cash flow more effectively, and make adjustments to improve your financial stability.

Free Financial Dashboard: Personal Capital offers a centralized place to view all your financial accounts in one place. This dashboard provides a comprehensive overview of your finances, making it easier to manage multiple accounts and track your financial progress.

Personal Capital Pros

Extensive investment tracking and analysis tools provide a detailed view of your investment portfolio.

Comprehensive retirement planning features help you set and achieve long-term financial goals.

User-friendly financial dashboard offers a clear and organized view of your overall financial health.

Free to use with optional premium services, allowing users to access essential features without any cost.

Integration with a wide range of financial institutions ensures that you can connect and manage all your accounts in one place.

Personal Capital Cons

Limited budgeting features compared to Mint may not meet the needs of users who prioritize detailed budgeting.

Some advanced features may be overwhelming for casual users who do not require in-depth financial analysis.

Premium services come at a cost, which may not be suitable for all users, particularly those looking for completely free solutions.

Primarily geared towards users with substantial investment portfolios, making it less appealing for those who do not have significant investments.

Personal Capital Pricing

Personal Capital offers a free financial dashboard with no cost for basic features. Premium services, including personalized wealth management, are available for a fee based on the assets under management. This pricing model allows users to access essential financial tracking tools for free while providing advanced services for those who need more personalized financial advice and management. The fee structure for premium services is designed to scale with the user's assets, making it a flexible option for individuals with varying levels of investment.

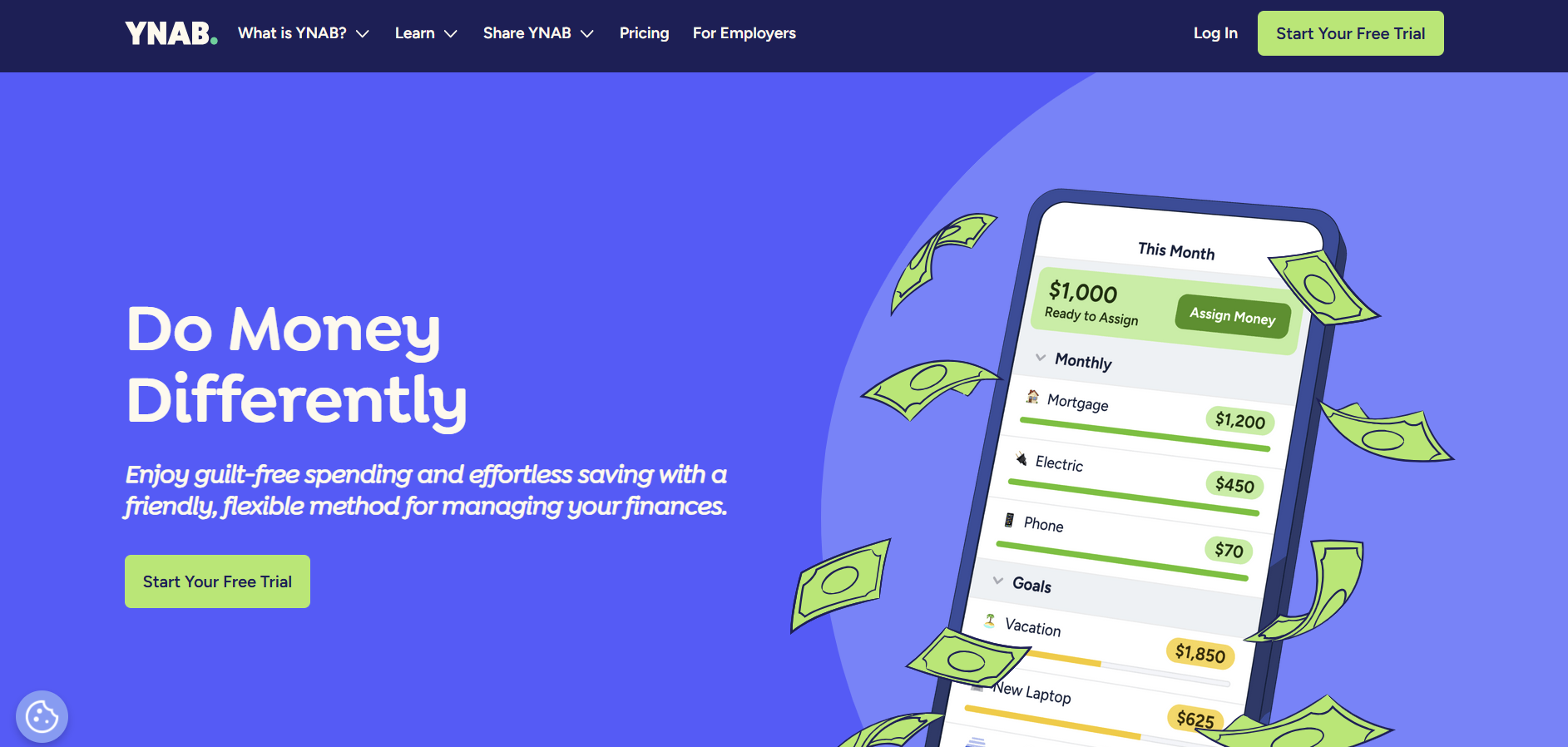

YNAB

YNAB (You Need A Budget) is a powerful budgeting tool that focuses on proactive budgeting methodologies. It is designed to help users take control of their finances by allocating every dollar to a specific purpose, promoting disciplined financial habits and long-term financial stability. YNAB's approach encourages users to plan their spending in advance, ensuring that they are intentional with their money and work towards their financial goals effectively. The tool's philosophy is built around the idea of giving every dollar a job, which helps users avoid unnecessary spending and build a solid financial foundation.

YNAB vs Mint

While Mint offers a comprehensive view of your finances, YNAB is specifically tailored for budgeting enthusiasts who want to implement strict budgeting practices. YNAB emphasizes proactive budgeting and financial planning, encouraging users to assign every dollar a job, which can lead to more effective money management. Unlike Mint, which automatically categorizes transactions and provides a broad overview, YNAB requires users to actively manage their budget, making it a more hands-on approach to financial management. This active engagement helps users develop better financial habits and gain a deeper understanding of their spending patterns.

Key Features of YNAB

Zero-Based Budgeting: Allocate every dollar of your income to specific categories, ensuring intentional spending. This feature helps users plan their finances meticulously and avoid unnecessary spending.

Real-Time Expense Tracking: Keep track of your spending as it happens with real-time updates. This allows you to monitor your budget closely and make adjustments as needed to stay on track.

Goal Setting: Set and monitor financial goals, such as saving for a vacation or paying off debt. YNAB's goal-setting tools help you create actionable plans to achieve your financial objectives.

Debt Management Tools: Tools to help you plan and execute debt repayment strategies. These tools assist you in creating debt reduction plans and tracking your progress towards becoming debt-free.

Educational Resources: Access to budgeting workshops, tutorials, and a supportive community. YNAB provides extensive educational materials to help users improve their financial literacy and budgeting skills.

YNAB Pros

Encourages disciplined and proactive budgeting habits, helping users take control of their finances.

User-friendly interface with intuitive design makes it easy to navigate and manage budgets.

Comprehensive educational resources to help users improve their financial literacy and budgeting skills.

Real-time tracking and updates for accurate budgeting and financial management.

Strong community support and user engagement provide additional motivation and assistance.

YNAB Cons

Subscription-based pricing may be a barrier for some users who prefer free solutions.

Limited investment tracking and financial reporting features compared to more comprehensive tools.

Requires a commitment to regularly update and manage your budget, which may not be suitable for all users.

No free version available after the initial trial period, limiting access to users who are not ready to commit financially.

YNAB Pricing

YNAB operates on a subscription model, offering monthly and annual plans. Users can start with a free trial before committing to a paid subscription. This pricing structure allows users to try out the platform and determine if it meets their budgeting needs before committing to a long-term plan. The subscription fees are justified by the extensive budgeting features and educational resources that YNAB provides, making it a worthwhile investment for users dedicated to improving their financial management skills.

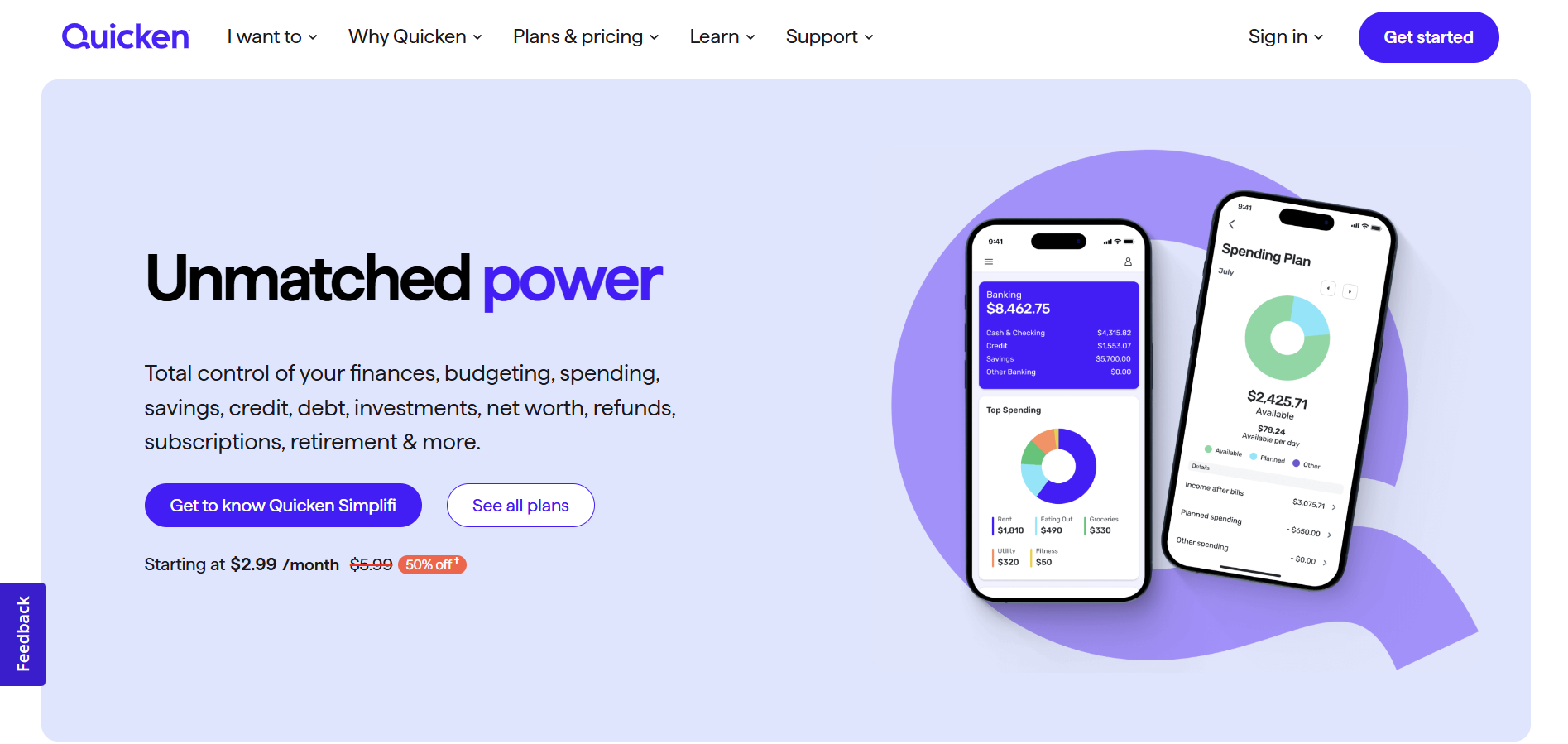

Quicken

Quicken is a long-standing personal finance tool that offers a wide range of features for budgeting, expense tracking, and investment management. It is particularly suited for users who require detailed financial reporting and advanced financial management tools. Quicken's extensive feature set makes it a versatile tool for managing various aspects of personal finance, providing users with the ability to track their finances comprehensively. Whether you're managing personal expenses, tracking investments, or preparing for taxes, Quicken offers the tools needed to handle complex financial tasks efficiently.

Quicken vs Mint

Quicken provides more advanced financial management and reporting features compared to Mint, which focuses primarily on budgeting and expense tracking. Quicken's robust set of tools is ideal for users who need in-depth financial analysis, investment tracking, and comprehensive reporting capabilities. While Mint is more automated and user-friendly for basic financial management, Quicken offers a deeper level of control and customization for users who require more detailed financial management. This makes Quicken a better fit for individuals who have more complex financial situations and need advanced tools to manage their finances effectively.

Key Features of Quicken

Comprehensive Budgeting Tools: Create detailed budgets with customizable categories and subcategories. Quicken allows users to tailor their budgets to their specific financial needs and preferences, offering flexibility and control over financial planning.

Investment Tracking: Monitor and analyze your investment portfolio with detailed reports. Quicken provides tools to track the performance of your investments, helping you make informed decisions and optimize your investment strategies.

Bill Management: Schedule and track bill payments to avoid late fees. This feature ensures that you never miss a payment and helps you stay on top of your financial obligations, contributing to better financial health.

Debt Tracking: Manage and track multiple debts with repayment plans. Quicken offers tools to create and manage debt repayment strategies, helping users reduce their debt effectively and efficiently.

Advanced Reporting: Generate customized financial reports for better financial insights. Quicken's reporting tools provide detailed insights into your financial health, allowing for informed decision-making and strategic financial planning.

Mobile App: Access your financial data on the go with the Quicken mobile app. This feature provides flexibility and convenience, allowing users to manage their finances from anywhere, at any time.

Quicken Pros

Extensive financial management and reporting features provide a comprehensive view of your finances.

Robust investment tracking and analysis tools help users manage and grow their investment portfolios.

Customizable budgeting options to fit various financial needs and preferences.

Integration with multiple financial institutions for comprehensive tracking of accounts.

Support for multiple users and accounts, making it suitable for households and families.

Quicken Cons

Higher cost compared to other personal finance tools may be prohibitive for some users.

Steeper learning curve due to its extensive feature set, making it less accessible for beginners.

Subscription model with annual fees may not be suitable for all users, particularly those seeking free solutions.

Limited collaboration features for shared budgeting and financial management among multiple users.

Quicken Pricing

Quicken offers several pricing tiers based on the features you need. Users can choose from Starter, Deluxe, Premier, and Home & Business plans, each with varying levels of functionality and support. This tiered pricing model allows users to select a plan that best fits their financial management needs and budget, providing flexibility and customization. The higher-tier plans offer more advanced features, making Quicken a scalable solution for individuals and families with evolving financial management needs.

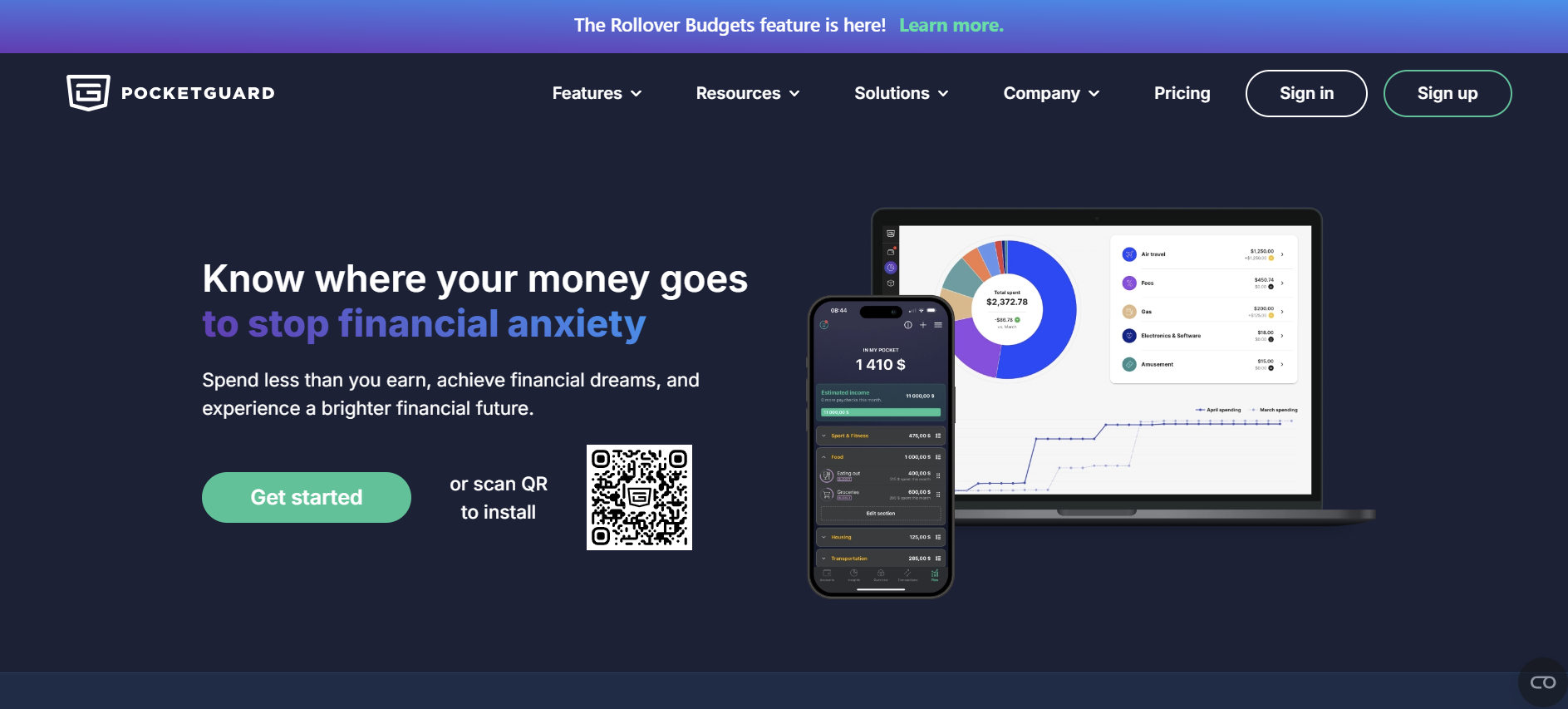

PocketGuard

PocketGuard is a user-friendly personal finance app designed to simplify budgeting and expense tracking. It focuses on helping users understand their spending habits and find opportunities to save money. PocketGuard's intuitive interface and straightforward approach make it an excellent choice for individuals who want to manage their finances without the complexity of more feature-rich tools. The app's design emphasizes simplicity and ease of use, ensuring that users can navigate and utilize its features effectively without feeling overwhelmed.

PocketGuard vs Mint

PocketGuard offers a streamlined and intuitive interface compared to Mint, making it easier for users to track their spending and manage their budgets without getting overwhelmed by excessive features. While Mint provides comprehensive financial tracking, PocketGuard emphasizes simplicity and ease of use, making it ideal for users who prefer a straightforward approach to personal finance. PocketGuard also includes features like automatic savings goals and real-time spending insights, which help users stay on top of their finances effortlessly. This balance between simplicity and functionality makes PocketGuard a compelling alternative for those seeking an uncomplicated yet effective personal finance tool.

Key Features of PocketGuard

Spending Overview: Get a clear picture of your spending habits with intuitive charts and summaries. PocketGuard helps users visualize where their money is going, making it easier to identify areas for improvement and make informed financial decisions.

Budget Tracking: Set and monitor budgets for various categories to stay on track with your financial goals. PocketGuard allows users to create customized budgets and track their progress in real-time, ensuring that they adhere to their financial plans.

Savings Goals: Create and track savings goals to motivate and manage your savings efforts. This feature helps users set and achieve specific financial goals, such as saving for a vacation or building an emergency fund, by providing clear targets and tracking progress.

In-App Notifications: Receive alerts for upcoming bills, low balances, and overspending. These notifications help users stay informed about their financial status and prevent overspending by alerting them to potential issues before they become problematic.

Link Bank Accounts: Securely connect multiple bank accounts to get a unified view of your finances. PocketGuard aggregates data from various accounts, providing a comprehensive overview of your financial health and making it easier to manage multiple sources of income and expenses.

PocketGuard Pros

Simple and intuitive interface, ideal for beginners who want an easy-to-use budgeting tool.

Real-time tracking and updates for accurate budgeting and financial management.

Automated categorization of expenses for easy monitoring and analysis.

Personalized insights and recommendations to help save money and optimize spending.

Free version available with essential features, making it accessible to a wide range of users.

PocketGuard Cons

Limited investment tracking and financial reporting features compared to more comprehensive tools like Personal Capital or Quicken.

Advanced features require a paid subscription, which may not be suitable for all users.

Less customizable compared to more comprehensive tools like Quicken, limiting flexibility for users with specific financial needs.

May not suit users with complex financial needs who require detailed financial management and reporting tools.

PocketGuard Pricing

PocketGuard offers a free version with basic features, allowing users to manage their finances without any cost. The Plus and PocketGuard Plus plans provide additional functionalities, such as advanced budgeting tools and custom categories, available through subscription-based pricing. These premium plans offer enhanced features for users who need more comprehensive financial management tools and are willing to pay for added convenience and functionality. The subscription fees are competitive and provide access to advanced features that can significantly enhance financial management capabilities.

EveryDollar

EveryDollar is a budgeting tool developed by financial expert Dave Ramsey. It focuses on providing a straightforward approach to budgeting, emphasizing the importance of allocating every dollar to specific financial goals. EveryDollar's methodology is rooted in zero-based budgeting, which helps users take control of their finances by ensuring that every dollar has a purpose. This approach not only helps in tracking expenses but also in planning for future financial goals, promoting a disciplined and structured approach to personal finance.

EveryDollar vs Mint

EveryDollar's primary focus is on budgeting and debt management, following the zero-based budgeting methodology advocated by Dave Ramsey. Unlike Mint, which offers a broader range of financial tracking features, EveryDollar centers around creating and maintaining a budget that ensures every dollar is assigned a purpose, promoting disciplined spending and saving habits. This focused approach makes EveryDollar an excellent tool for users who want to prioritize budgeting and debt reduction over other aspects of financial management. By concentrating on budgeting and debt management, EveryDollar helps users develop strong financial habits that can lead to long-term financial stability and success.

Key Features of EveryDollar

Zero-Based Budgeting: Allocate every dollar of your income to specific categories, ensuring intentional spending. This feature helps users plan their finances meticulously and avoid unnecessary spending, fostering a sense of control and responsibility over their money.

Debt Tracking: Tools to manage and track debt repayment progress. EveryDollar provides features that help users create and follow debt repayment plans, making it easier to eliminate debt systematically and achieve financial freedom.

Goal Setting: Set and monitor financial goals, such as saving for a down payment or building an emergency fund. These goals help users stay motivated and focused on achieving their financial objectives, providing a clear path to financial success.

Expense Tracking: Easily track and categorize expenses to stay within budget limits. EveryDollar's expense tracking tools allow users to monitor their spending and ensure they are adhering to their budget, promoting financial discipline and accountability.

Mobile App: Access your budget and track expenses on the go with the EveryDollar mobile app. This feature provides flexibility and convenience, allowing users to manage their finances from anywhere, at any time, ensuring that they can stay on top of their budget no matter where they are.

EveryDollar Pros

Simple and intuitive interface, ideal for budgeting beginners who want an easy-to-use tool.

Emphasizes disciplined budgeting and financial planning, helping users take control of their finances.

User-friendly expense tracking with easy categorization, making it simple to monitor spending.

Integration with Dave Ramsey's financial principles and resources provides additional guidance and support.

Free version available with essential budgeting features, making it accessible to a wide range of users.

EveryDollar Cons

Limited investment tracking and financial reporting capabilities compared to more comprehensive tools.

Advanced features, such as bank account linking, require a paid subscription, which may not be suitable for all users.

May not be suitable for users seeking comprehensive financial management tools beyond budgeting and debt tracking.

Less customizable compared to more advanced budgeting platforms, limiting flexibility for users with specific financial needs.

EveryDollar Pricing

EveryDollar offers a free version with basic budgeting features, allowing users to manage their finances without any cost. The EveryDollar Plus plan provides additional functionalities, including bank account linking and automatic expense tracking, available through a subscription-based model. These premium features offer enhanced convenience and functionality for users who want a more comprehensive budgeting tool and are willing to pay for added benefits. The subscription fees are reasonable and provide access to advanced features that can significantly enhance budgeting and financial management capabilities.

FAQs On Mint Alternatives

1. What are the top alternatives to Mint?

The top alternatives to Mint include tools like Personal Capital, YNAB, Quicken, PocketGuard, and EveryDollar. These platforms offer diverse features for budgeting, expense tracking, investment management, and debt reduction, catering to various personal finance needs. Each alternative provides unique strengths that can help users manage their finances more effectively, depending on their specific requirements and preferences. Whether you're looking for advanced investment tracking, strict budgeting methodologies, or user-friendly interfaces, these alternatives have something to offer for every type of user.

2. Why should I consider using an alternative to Mint?

Alternatives to Mint may offer benefits such as more comprehensive investment tracking, different budgeting methodologies, enhanced reporting features, or flexible pricing models. They can provide a better fit for your specific financial goals, preferences, and requirements, helping you manage your finances more effectively. Exploring these options allows you to find a tool that aligns better with your personal financial management style and needs. Additionally, some alternatives may offer better data privacy and security features, which can be a significant consideration for users concerned about their financial information's safety.

3. Are Mint alternatives free to use?

Many Mint alternatives offer free versions with essential features, while others provide premium plans with advanced functionalities. For example, Personal Capital and PocketGuard offer free basic services, whereas YNAB and Quicken operate on subscription-based models. The cost varies by platform and the level of features you require, allowing users to choose an option that fits their budget and financial management needs. Some alternatives also offer free trials, enabling users to test the features before committing to a paid plan, ensuring that they find the best fit for their financial management needs without any upfront costs.

4. Which Mint alternative is best for beginners?

For beginners, PocketGuard and EveryDollar are excellent alternatives to Mint. They provide user-friendly interfaces, easy-to-use budgeting tools, and straightforward expense tracking, making financial management simple for newcomers. These platforms are designed to be intuitive and easy to navigate, helping beginners manage their finances without feeling overwhelmed by complex features. Additionally, these tools offer helpful resources and support to guide new users through the budgeting process, ensuring that they can effectively manage their finances from the start.

5. Can I use Mint alternatives for professional financial planning?

Yes, many Mint alternatives like Personal Capital and Quicken offer professional-grade features suitable for comprehensive financial planning. These tools provide advanced investment tracking, detailed financial reports, and planning resources that cater to more sophisticated financial management needs. They are ideal for users who require in-depth financial analysis and planning tools to manage their finances professionally. Whether you're planning for retirement, managing a complex investment portfolio, or seeking detailed financial insights, these alternatives provide the necessary tools and features to support professional financial planning and management.

Conclusion

Choosing the right personal finance management tool is crucial for effectively managing your finances and achieving your financial goals. While Mint is a popular choice, exploring its alternatives can help you find a platform that better aligns with your specific needs and preferences. Whether you require comprehensive investment tracking, strict budgeting methodologies, advanced reporting features, or a user-friendly interface, the alternatives discussed—Personal Capital, YNAB, Quicken, PocketGuard, and EveryDollar—offer a range of functionalities to cater to various financial management styles. By evaluating the features, pros, cons, and pricing of each alternative, you can make an informed decision that supports your financial well-being and helps you maintain control over your personal finances.